The rise of electric vehicles (EVs) has been accompanied by a persistent concern among consumers: battery safety, particularly the risk of thermal runaway and fires. BYD, a leading Chinese automaker and battery manufacturer, has sought to address these fears with its innovative Blade Battery technology. Unlike conventional lithium-ion batteries, the Blade Battery promises not only higher energy density but also significantly improved safety, potentially redefining industry standards.

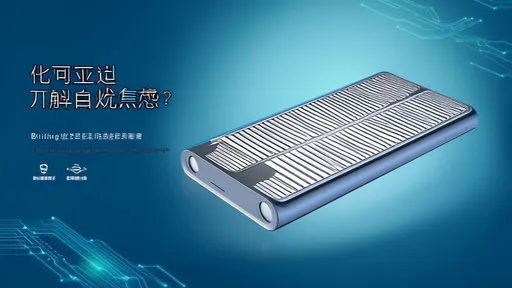

At the heart of BYD’s breakthrough is the battery’s unique cell-to-pack (CTP) design. Traditional EV batteries consist of individual cells bundled into modules, which are then assembled into a larger pack. The Blade Battery eliminates the modular middle step, integrating long, thin cells directly into the pack. This structural innovation not only maximizes space utilization but also enhances thermal stability. The lithium iron phosphate (LFP) chemistry used in the Blade Battery is inherently less prone to overheating compared to nickel-cobalt-manganese (NCM) batteries, which dominate the market. When subjected to extreme conditions like nail penetration—a standard test for thermal runaway—the Blade Battery emits no smoke or fire, a claim few competitors can match.

Safety, however, is only part of the story. The Blade Battery’s compact design allows for greater energy storage within the same physical footprint, addressing another critical EV challenge: range anxiety. BYD’s proprietary battery management system (BMS) further optimizes performance, ensuring efficient power distribution and longevity. Real-world adoption has been swift, with the Blade Battery powering models like the Han EV, which boasts a range of over 600 kilometers on a single charge. For consumers, this translates to fewer compromises between safety and practicality.

Industry analysts note that BYD’s approach could disrupt the global EV market. While Western automakers have largely favored NCM batteries for their higher energy density, the Blade Battery’s safety advantages and declining cost of LFP technology are shifting the calculus. Tesla, for instance, has already begun incorporating LFP batteries in some of its entry-level models. BYD’s vertical integration—it produces both batteries and vehicles—gives it an edge in scaling production and refining the technology. The company’s decision to open its battery supply to other automakers could accelerate adoption beyond its own lineup.

Yet challenges remain. Despite its safety credentials, the Blade Battery’s energy density still lags behind top-tier NCM batteries, limiting its appeal for high-performance vehicles. BYD is betting that incremental improvements, coupled with consumer prioritization of safety, will narrow this gap. Meanwhile, competitors are exploring alternative solutions, such as solid-state batteries, which promise even greater safety and energy density. The race to dominate next-generation EV batteries is far from over, but BYD has positioned itself as a formidable contender.

For EV skeptics, the Blade Battery offers a compelling counterargument to the "spontaneous combustion" narrative. BYD’s rigorous testing and transparency—including public demonstrations of its nail penetration tests—have bolstered consumer confidence. As governments worldwide push for stricter emissions standards, the demand for safer, more reliable batteries will only grow. The Blade Battery may well become a benchmark, proving that cutting-edge technology and peace of mind can coexist on the road to electrification.

By /Jun 15, 2025

By /Jun 15, 2025

By /Jun 15, 2025

By /Jun 15, 2025

By /Jun 15, 2025

By /Jun 15, 2025

By /Jun 15, 2025

By /Jun 15, 2025

By /Jun 15, 2025

By /Jun 15, 2025

By /Jun 15, 2025

By /Jun 15, 2025

By /Jun 15, 2025

By /Jun 15, 2025

By /Jun 15, 2025

By /Jun 15, 2025

By /Jun 15, 2025